Every trader (or investor) is familiar with long positions. Expecting the price to rise, a trader simply purchases the shares, then later sells these shares for a profit or loss. This is as simple as can be.

However, stock prices can just as easily go down as they go up. In the case of falling prices, a trader cannot profit from long positions. Through a process called short selling, a trader can profit when a stock’s price goes down. Unlike long positions, there are some inherent risks to short positions. The overall short selling process is also more complicated and counter-intuitive than simply buying and selling shares.

How Does Short Selling Work?

The overall process for short selling works as follows:

- Broker finds shares for the trader to borrow.

- Trader proceeds to borrow, then sell these shares on the market.

- Later, these shares are repurchased (covered) to realize a profit or loss.

- The borrowed shares are returned to the broker.

Short selling also requires a margin account and the broker charges some interest on the borrowed shares.

Since short selling involves a somewhat counter-intuitive process and a special type of account, it may be perceived to be an advanced technique, only to be undertaken by experienced and professional traders.

Even though the process above may seem complicated, a broker handles all the details of borrowing shares, charging interest, calculating the realized gain/loss, etc. In practice, short selling is no more complicated than buying and selling shares for a long position. As far as a trader is concerned, the process for short selling is basically the reverse of the process for establishing a long position; a trader simply sells the shares first, then buys them back (covers them) later.

Why Short Selling Can Be Risky

In a long position, the most a trader can at most lose 100% of the position’s market value at the time of purchase; this would only happen if the stock’s price decreased to zero. However, in a short position, there is no limit to how much the price can increase; therefore, a trader could potentially lose more than 100% and owe money to their broker.

There are certainly cases where traders have gotten themselves into deep trouble through short selling. For example, in one well-known case, a trader took a large short position in a volatile biotech stock and suffered huge losses when the price skyrocketed.

Business Leaders Versus Short Sellers

Business leaders of publicly traded companies do their best to grow their companies, provide value for their shareholders, and to present their company in a positive light. If business is growing and there is lots of good news, the expectation is the company’s share price will increase.

Short sellers, on the other hand, perceive a weakness in the price trend, business performance, or other factors and bet the share price will go down. Short-sellers therefore have an opposing viewpoint versus business leaders. Given this opposing viewpoint, short sellers are sometimes negatively portrayed by business leaders in the media.

This opposing viewpoint may also contribute to some traders initially having a negative bias towards short selling, thinking the practice could be unethical, may harm a company, negatively impact a company’s employees, etc.

Why it’s Perfectly Natural to Bet on Falling Prices

Fundamentally, a falling price is just as natural as a rising price. In fact, it is arguably easier for a a price to fall than it is to rise.

In particular, there are 2 ways for a price to fall: (1) there is no demand at the asking price, and the price falls under its own weight, or (2) there are more sellers than buyers which also drives the price down. However, the only way a price can rise is when buying continues to outstrip selling and prices increase. In other words:

There is a saying on Wall Street: “It takes buying to put prices up, but they can fall of their own weight”. — Dr. Alexander Elder

Along these lines, one way to better understand and visualize the dynamics of supply, demand and price is to use a hot air balloon as an analogy. In particular:

- A hot air balloon only rises when fuel is given to its burner. Similarly, a stock’s price only rises when there is enough fuel to keep demand strong. This fuel can come from many sources, such as strong revenue, earnings growth, or good news about products.

- When a hot air balloon runs out of fuel, it will fall under its own weight. Similarly, if there is nothing fueling demand for a stock, the price will fall under its own weight.

- Hot air balloons have passengers who weigh down the balloon. These passengers are not unlike sellers, who can also weigh down a stock’s price. There can be any number of reasons for selling, including profit-taking and short selling; either way, the end result is to drag the price lower, or at least prevent its rise.

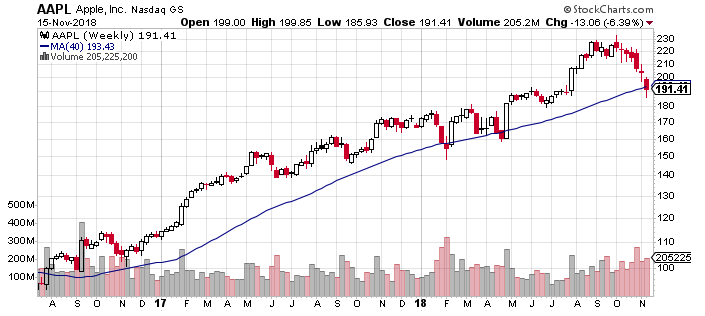

Apple is the perfect example of a stock which, to use the hot air balloon analogy, is likely “running low on fuel”. As a result, the price has been falling:

In the case of Apple, there have been concerns about weak demand for iPhones. To date (November, 2018), Apple has experienced unprecedented success, and some long term investors are undoubtedly selling to take profits. Moreover, there are certainly traders who have been short selling. Finally, there are also potential buyers on the sidelines, who will not purchase shares until the news improves. All these factors contribute to a falling price. The only factor which will make the price go up again is for enough buyers to come off the sidelines to overwhelm all the selling.

Thinking fundamentally about supply, demand and price, it is a perfectly natural phenomenon for price to fall. If a trader does an objective analysis of supply and demand, and believes a stock’s price is likely to fall, short selling is just a means to potentially profit from this analysis.

Adding Short Selling to Your Trading Toolbox

If short selling is counter-intuitive, requires a margin account, risks losing more than 100% of a position’s initial market value, and sometimes gets a negative portrayal from business leaders, is it really worth the trouble to private/retail traders? In my opinion, it definitely is, but only in certain timeframes, with strict risk control, and only with certain types of stocks.

As a private/retail trader, most of my trading is with long positions that I hold anywhere from weeks to a few months. I’m not primarily a day trader, but I do occasionally short-sell stocks on an intraday (day trading) timeframe. The rules I personally use to very carefully manage risk include:

- Never short sell biotech stocks which could potentially experience a dramatic price increase (e.g., with FDA approval of a new medical device or drug).

- Keep position sizes small, so even if the price does increase, I’m not exposed to a significant loss.

- Only short sell stocks (or ETFs) with excellent liquidity, so I can more than likely get out of the stock at any price.

- Only short sell on an intraday (day trading) timeframe. This way I’m not exposed to overnight risk and potentially wild price swings.

- Use tight stops, so I’ll get out of the position relatively quickly in the event of a short squeeze.

Even if you’re not primarily a short seller, having this type of trading in your repertoire can be beneficial in the following ways:

- Understanding both sides of a trade: Knowing how to short sell definitely helps a trader understand the mindset of other market participants; i.e., when deciding whether to enter a long position, it is good to play devil’s advocate and evaluate the entry from a short seller’s perspective.

- Trading in bearish market conditions: When market conditions aren’t good for long trades, short selling puts the money in a trading account to work on other types of trades; moreover, making some money through short selling also helps to offset the negative emotions associated with a bearish market.

Summary

Short selling comes with some risks and negative connotations. This can result in a negative bias from traders who are not yet experienced with this type of trading.

Even though short selling can be risky, many of the risks can be overcome through careful risk management. The concept of short selling is also somewhat counter-intuitive. However, in practice, a broker handles the more complex details of short selling; from the standpoint of a trader, short selling is quite straightforward.

If a long-only trader can overcome a negative bias and learn how to short-sell, a trader not only adds a new type of trade to his or her trading toolbox, but also benefits from understanding the mindset of traders on both sides of a trade.

Further Reading

Short Selling 101: How to Short a Stock and Make Money As It Falls