Last year, I bought a Model 3 Tesla. It was eligible for a $7500 tax credit and I just received this as a refund from my 2023 tax return. In April of this year, Tesla also gave me a one month free trial of their Full Self-Driving (FSD) upgrade.

Having driven with FSD for a month, I definitely believe it improves the overall driving experience and makes me a safer driver. I basically treat FSD as an enhanced cruise control, where I’m still supervising the controls of the car, but FSD otherwise takes care of 80-90% of the driving, including:

- Navigate on Autopilot

- Auto Lane Change

- Autopark

- Summon

- Smart Summon

- Autosteer on city streets

- Traffic Light and Stop Sign Control

Options After the Free Trial

Based upon my experience, FSD is definitely worth the one-time upgrade cost or monthly subscription fee. It’s just a question of how to pay for it; so with the free trial expiring, there was a decision whether to:

- Purchase the FSD upgrade outright for $8000, which will be applicable for as long as I own the car; or,

- Subscribe for $99/month.

I can afford to pay the $8000 upfront or $99/month subscription fee. However, a third option is to:

- Invest the $7500;

- Round it up to $8000 to match the FSD purchase price; and,

- Pay the $99 per month subscription fee.

Then, as long as my $8000 investment increases over time, the net cost of the monthly subscription goes down. This 3rd option is effectively a “cash flow hedge” since the investment returns are expected to offset the cash outflow of buying or subscribing to FSD on its own.

Inputs and Assumptions

For purposes of modeling different financing options, I’m going to assume:

- I keep the car for another eight years;

- The subscription price doesn’t change; and,

- The FSD upgrade is not transferable.

At any point in time, Tesla could decide to increase the price of the monthly subscription. Conversely, they could also reduce it below $99, but I believe this is a pretty good price point already. Tesla could also decide to allow the transfer of FSD for customers who bought it upfront. They already did this earlier this year, but only for a limited time. This would make paying the full FSD price more attractive since I could only pay once, but have FSD on multiple vehicles. If any of these changes occur, I’ll reevaluate my investment position relative to the future cost and value of FSD.

Financing Scenarios Compared Over Time

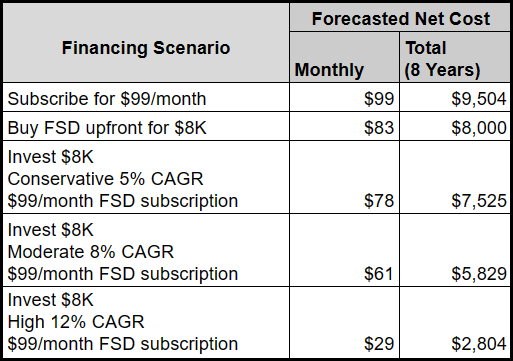

Based upon the inputs and assumptions above, the table below summarizes a forecasted net cost for a number of scenarios. Besides buying the upgrade outright or subscribing without investing, a few investment scenarios are provided with varying rates of return; this allows us to see how compounded annual growth rate (CAGR) impacts the monthly and overall net cost.

Hedging with a Tesla Stock Purchase

Investing the $8K in a mutual fund, index fund or similar would be a diversified investment. However, another alternative is to invest this money back into a Tesla stock purchase; then, if Tesla turns out to be a growth stock again over the next eight years, I could effectively pay for some or all of my FSD subscription fees with investment gains.

There’s really no objective reason to invest in Tesla instead of another more diversified investment option. However, for this experiment, reinvesting in Tesla accomplishes several things:

- I’ll be more of a stakeholder - By reinvesting in Tesla, I’m also effectively doubling down on FSD and Tesla. If Tesla wins, we both win.

- Reinvesting in Tesla will keep me more interested in this experiment over time.

- Limited downside - If Tesla’s stock price doesn’t increase signficantly, or the FSD subscription price goes up considerably, I’ll just go back to driving myself … worst case scenario, I’ll still have a great non-FSD driving experience.

Below are the steps I have taken to make this scenario happen:

- Setup a dedicated trading account with an $8k starting balance.

- Purchased 42 Tesla shares at $188.39/share on 4/29/2024.

- Enrolled in the $99/month FSD subscription.

For reference, below is the weekly stock chart for Tesla on the day of the stock purchase:

Final Thoughts and Next Steps

The Tesla FSD hedge trade offers a creative financing strategy for Tesla owners who want to enjoy the benefits of FSD technology while minimizing upfront or recurring costs. By making an investment which is expected to offset the monthly FSD subscription fee, the net cost of FSD can be reduced over time. Going forward, I’m excited to continue experiencing the enhanced driving experience FSD provides, while also seeing how this experiment plays out over time.